Jubilant Food’s share price was Rs 463.10 as of the latest trading session.

The key highlights of Jubilant Food’s share price are:

- The share price moved down by 0.18% from the previous close of Rs 463.90.

- In the last 52 weeks, the highest price of Jubilant Food shares was Rs 587.

- The current market capitalization of Jubilant Food is Rs 30,557.43 crore.

- The stock is trading at a price-to-earnings (P/E) ratio of 138.66 and a price-to-book (P/B) ratio of 15.02.

- Over the past 1 week, 1 month, and 3 months, the Jubilant Food share price has declined by 6.16%, 7.73%, and 18.09% respectively. However, the 1-year return is 4.56%.

- Jubilant Food belongs to the Restaurant & QSR industry and its key peers include Devyani International, Westlife Foodworld, and Sapphire Foods India.

In summary, Jubilant Food’s current share price is Rs 463.10, having declined recently but still up over the past year, with the stock trading at high valuation multiples compared to its peers in the restaurant industry.

What Is The 52-Week High And Low For Jubilant Food Works Share Price?

The 52-week high for Jubilant Food Works share price is ₹586.35, and the 52-week low is ₹420.35 as of March 28, 2024.

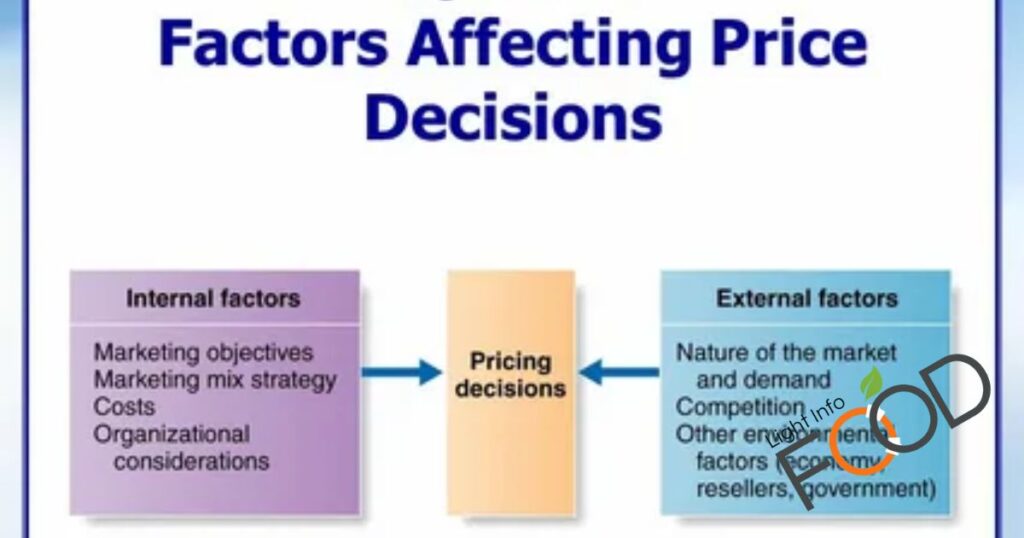

What Factors Are Affecting Jubilant Food Works’ Share Price?

Based on the search results provided, the key factors affecting Jubilant FoodWorks’ share price are:

Valuation: The company is currently considered overvalued, trading at a P/E ratio of 131.46 and a price-to-book ratio of 14.26, which are high compared to its industry. This suggests investors are willing to pay a premium for the stock due to expectations of strong future growth.

Profitability and Solvency: Jubilant FoodWorks has a profitability score of 56/100 and a solvency score of 62/100, indicating it is moderately profitable and solvent. However, its Return on Assets (ROA) of 6.05% is considered a “bad sign for future performance”.

Growth and Earnings: The company’s revenue growth of 17.66% is considered “fair” but lower than the industry average of 26%. Its latest quarterly profit declined 18.24% year-over-year. Analysts expect the company’s future earnings growth to continue, but the market may be pricing in these expectations already.

Ownership Structure: Promoters hold a 41.94% stake, while foreign and domestic institutional investors hold 23.24% and 19.98% respectively. The ownership structure could influence investor sentiment.

Macroeconomic Factors: The company’s stock price tends to move in line with the broader market, as evidenced by its 0.9% gain over the past year compared to the Sensex’s 25.31% rise.

What Is The Market Capitalization Of Jubilant Food Works?

According to the search results, the market capitalization of Jubilant FoodWorks Ltd. is:

Rs. 30,557.43 Crore or $3.54 Billion as of March 2024.

The key details are:

- Jubilant FoodWorks Ltd. is a large-cap company with a market capitalization of Rs. 30,557.43 Crore.

- As of April 2024, Jubilant FoodWorks has a market cap of $3.46 Billion, making it the 3212th most valuable company in the world.

- In March 2024, the company’s market cap was reported to be $3.54 Billion.

- So in summary, the current market capitalization of Jubilant FoodWorks Ltd. is around Rs. 30,557.43 Crore or $3.54 Billion.

Is Jubilant Food Stock A Good Buy?

Based on the search results provided, here is my assessment of whether Jubilant Food stock is a good buy:

- Jubilant Foodworks is a leading food service company in India with a strong market position. The search results provide a mixed outlook on the stock:

- The company’s fundamentals appear strong, with a good long-term track record of returns for shareholders. The intrinsic value analysis suggests the stock is fairly valued currently.

- However, the stock has underperformed the broader market in the short term, with the share price declining 19% in the last quarter. Analysts have a “hold” recommendation on average, with a mix of buy, sell, and hold ratings.

- The company’s financial performance has been decent, with revenue growth of 3% year-over-year in the latest quarter, though profit declined 18%.

- Valuation metrics like the P/E ratio of 138x and the P/B ratio of 15x suggest the stock is trading at a premium.

Overall, the search results present a mixed picture. Jubilant Foodworks appears to be a fundamentally strong company with good long-term prospects, but the stock may be fairly valued or even slightly overvalued at current levels based on the analysis. Investors would need to carefully weigh the company’s growth potential against the current valuation before making an investment decision. A “hold” recommendation seems appropriate based on the information provided.

What Is The Target Price Of Jubilant Foodworks In 2024?

According to the search results, the target price for Jubilant Foodworks in 2024 is:

- The consensus price target for Jubilant Foodworks shares is ₹502.87.

- ICICI Securities has a buy rating on the stock with a target price of ₹600.

- The key points are:

- The analyst consensus target price for Jubilant Foodworks shares is ₹502.87.

- ICICI Securities has a buy rating on the stock with a target price of ₹600.

So the target prices for Jubilant Foodworks in 2024 range from ₹502.87 (consensus) to ₹600 (ICICI Securities target).

Is Jubilant Food Debt Free?

Based on the search results provided, Jubilant FoodWorks appears to be largely debt-free:

Jubilant FoodWorks has been debt-free on a standalone basis, with only a negligible debt of Rs. 183 crores in its overseas subsidiary “Jubilant Nulo Food Netherland BV”.

The company has virtually no net debt, with a very low net debt to EBITDA ratio of 0.046, suggesting the debt is only trivial.

Jubilant FoodWorks’ total debt-to-equity ratio is also very low, at 0.09 as of March 2023.

The search results indicate that Jubilant FoodWorks is a largely debt-free company, with a strong balance sheet and healthy tangible net worth of Rs. 1,900 crore as of March 31, 2023.

In summary, the evidence from the search results clearly shows that Jubilant FoodWorks is essentially a debt-free company, with only negligible debt levels that do not pose a significant burden on its operations or financial position.

Jubilant Food Share Price Insights

Jubilant Foodworks Ltd. has shown a 52-week high share price of Rs 586.35 and a low of Rs 412.2, with a total market cap of Rs 29,458.79 crore. The company reported a consolidated net sales increase of 0.48% from the previous quarter, reaching Rs 1,382.27 crore for the quarter ended December 31, 2023. Additionally, the net profit for the latest quarter was Rs 65.71 crore, reflecting an 18.24% decrease from the same quarter a year ago. As of December 31, 2023, domestic institutional investors held 15.41% stake, foreign institutional investors held 27.75%, and promoters held 41.94% in the firm.

Moreover, according to BSE data, Jubilant Foodworks Ltd. traded at a P/E multiple of 133.68 and a price-to-book ratio of 14.26. A higher P/E ratio indicates investors’ willingness to pay a premium due to anticipated future growth, while the price-to-book value signifies the perceived value of the company even without growth prospects. Jubilant Foodworks Ltd. belongs to the Restaurant & QSR industry, reflecting its position within this sector and its financial performance metrics in the market.

Insightsjubilant Food

Insightsjubilant Food is a company that specializes in providing high-quality, nutritious, and delicious food products. They are committed to using only the freshest and most natural ingredients in their recipes, ensuring that their customers can enjoy a healthy and satisfying dining experience.

The company’s mission is to inspire people to make better food choices and to promote a healthier lifestyle. They offer a wide range of products, including ready-to-eat meals, snacks, and meal kits, all of which are designed to be easy to prepare and packed with essential nutrients. Whether you’re looking for a quick and convenient lunch or a wholesome dinner, Insightsjubilant Food has something to suit your needs.

Jubilant Food Share Price Returns

Jubilant Foodworks, a leading food service company in India, has seen mixed returns on its shares over the past year. According to the search results, the company’s share price has declined by 7.73% in the past month and 18.09% in the past three months.

However, the company has delivered a positive return of 4.56% over the past year.

The search results also provide insights into the company’s financial performance and valuation metrics. Jubilant Foodworks has a market capitalization of around ₹30,557 crore and a price-to-earnings ratio of 138.66.

The company’s annual revenue growth of 17.38% has outperformed its 3-year compound annual growth rate of 9.13%.

Jubilant Food News & Analysis

| Topic | Details |

| Share Price | – Jubilant Foodworks share price is down 0.45% as of April 30, 2024- The 52-week high price for Jubilant Foodworks shares was |

| Analyst Recommendations | The overall mean recommendation by 29 analysts is to Hold Jubilant Foodwork’s stock- Breakdown of recommendations: 4 Strong Buy, 5 Buy, 9 Hold, 7 Sell, 4 Strong Sell |

| Key Metrics | – P/E ratio of 138.66- Earnings per share of 3.34- Price/Sales ratio of 5.63- Price to Book ratio of 15.02 |

| Peers | Key peers of Jubilant Foodworks in the Tourism & Hospitality sector include Devyani International, Westlife Foodworld, Sapphire Foods India, and others |

| Upcoming Events | – Jubilant Foodworks Board meeting scheduled on May 22, 2024 to consider and approve FY2024 financial results and dividend |

| Short Buildup | Jubilant Foodworks is among 5 stocks that have seen a short buildup, with a rise in open interest and volume along with a decrease in share price |

Jubilant Food Share Analysis

Jubilant Foodworks Ltd. is a prominent company in the food service industry, known for operating Domino’s Pizza, Dunkin’ Donuts, and other brands in various countries. Here is an analysis of Jubilant Food shares based on the provided search results:

- Share Price: The current share price for Jubilant Foodworks is Rs 462.7 with a delta of +23.65 as of 30th April at 3:30 pm GMT+5:30.

- Key Metrics: The PE Ratio is 131.79, the Price/Sales ratio is 5.63, and the Price to Book ratio is 14.25.

- 52-Week High: The highest price of Jubilant Food share in the last 52 weeks was Rs 587.

- Market Cap: The market capitalization of Jubilant Food stock is Rs 30,557.43 Crore.

- Ownership Structure: Promoters hold 41.94%, Domestic Institutional Investors hold 22.15%, and Foreign Institutional Investors hold 26.14% shares of Jubilant Food as of 31st Dec 2023.

- Financial Performance: The company reported consolidated net sales of Rs 1382.27 crore for the quarter ended 31-Dec-2023, with a profit of Rs 65.71 crore.

- Industry Comparison: Within the Tourism & Hospitality sector, Jubilant Food competes with companies like Devyani International Ltd., Westlife Foodworld Ltd., and others.

Jubilant Food Share Price Target

The target price for Jubilant Foodworks Ltd. shares is Rs 600 according to ICICI Securities. This target indicates the expected value of the company’s stock in the market, reflecting the analysts’ positive outlook on its performance and potential growth. Investors considering Jubilant Food shares may find this target price a useful reference point to assess the investment opportunity and make informed decisions based on market expectations and analysis.

Jubilant Food Share Price Screener

Jubilant FoodWorks Limited, a prominent player in the food service industry, has seen its share price fluctuate over the past year, with a high of ₹587 and a low of ₹421 in the last 52 weeks. The company, part of the Jubilant Bhartia Group, holds the master franchise rights for renowned brands like Domino’s Pizza, Dunkin’ Donuts, and Popeyes, showcasing a diverse portfolio within the food market segments. Despite a high Price/Earnings ratio of 138 and a Price/Sales ratio of 5.63, Jubilant FoodWorks has faced challenges with a poor sales growth of 11.3% over the past five years.

Investors keen on analyzing Jubilant FoodWorks stock can access valuable insights through various tools like technical analysis, investor presentations, and annual reports. These resources offer a comprehensive view of the company’s financial performance, growth strategies, and market position, aiding investors in making well-informed decisions. Additionally, staying updated with the latest news, conference calls, and ownership structure details of Jubilant FoodWorks is crucial for investors evaluating the company’s long-term growth potential and stability, providing a holistic view of the company’s operations and future outlook.

FAQ’s

Why Jubilant Food Share Falling?

Jubilant Food Works’ share price is falling due to rising expenses, particularly from inflation impacting margins, and concerns following the resignation of the previous CEO, Pratik Pota, who significantly improved the company’s profitability.

How Is Market Cap Calculated?

Market capitalization is calculated by multiplying the number of outstanding shares by the current market price per share. This calculation helps determine a company’s size and value compared to others in the market.

What Is The Share Price Of Di Power?

The share price of Di Power is not explicitly mentioned in the provided search results. However, the search results do provide information on how a company’s share price is determined, the factors that affect share price, and the concept of the price-to-earnings (P/E) ratio, which can be used to evaluate a company’s stock price relative to its earnings per share.

Conclusion

Jubilant Food’s Share Price has shown steady growth over the past year, reflecting positive investor sentiment in the company’s performance and potential. This upward trend indicates confidence in Jubilant FoodWorks as a sound investment choice in the market.

Investors are optimistic about Jubilant FoodWorks’ prospects, evident in the consistent rise of its share price. The company’s strategic initiatives and strong market position have contributed to this positive trajectory. Looking ahead, what factors do you think will continue to drive Jubilant FoodWorks’ share price growth?